You can trust our senior Austin M&A advisors to guide you through the often difficult M&A process and achieve your goals for your business.

Corporate Investment provides sell side advisory services to successful lower middle-market business owners with values between $2 million and $20 million.

The process of selling a privately owned company is extremely complex, and since 1984 Corporate Investment has guided over 400 business owners through the business sale process. Corporate Investment has completed transactions in the manufacturing, distribution, B2B services and technology, healthcare, construction and engineering, and many other business sectors.

Lower middle-market sell side Austin M&A advisory firm serving Texas and the southwest

We meet confidentially with business owners to determine the goals they wish to achieve in the M&A transaction.

Our experienced transaction professionals then recommend the best approach to achieve the goals of the business owner, based upon our extensive experience with strategic buyers and financial buyers, such as private equity firms and family offices.

Whether our client chooses a broad auction, limited auction, or negotiated sale, we map out the steps required to achieve a successful transaction, and the approximate timeline. Our seasoned professionals execute the plan standing side-by-side with the business owner throughout the process.

When you choose Corporate Investment as your sell side M&A advisor, you get one-on-one access to our most senior advisors who will explore your options and advise you with key strategic moves in the process.

“

After listening to our needs and wants for the future of our company, you contacted a group who was able to help launch us in the direction we wanted to go...From the time you spent on researching the future housing market, to the constant recasting and forecasting of financials, your firm was always on top of what needed to be done. We could not have possibly had the time to do these ourselves. Your efforts allowed us to continue to run our business on a daily basis. We have already referred your firm to someone else and will continue to do so in the future.

Mike and Kelley Church

Owners, Cody Pools

Austin, TX

“

I interviewed multiple firms and picked Corporate Investment to represent me. Corporate Investment provided a high level of service through each phase of my sale. From preparing high quality, professional marketing materials, to engaging multiple prospective qualified buyers and negotiating the letter of intent... I am 100% satisfied with the work, advice and time Corporate Investment devoted to representing me in the sale of my business. Hiring Corporate Investment to sell my company proved to be the right decision for me.

Don Egigian

Owner, BullRing

Boerne, TX

“

Fifty percent of my adult life was spent building Dustless-Air Filter Company...After considering multiple brokers I decided to retain Corporate Investment. I can say with confidence that the decision to entrust Corporate Investment with the marketing and sale of my business proved to be an excellent choice...More than receiving top dollar for my company, their careful marketing to, and screening of, potential buyers resulted in the business being acquired by a team I am confident will continue the legacy I am proud of.

Kyle Gish

Owner, Dustless-Air Filter Company

Austin, TX

Schedule a No-Cost,

No-Obligation

Introductory

Consultation

Learn more about how our sell-side M&A advisory process will help you get what you deserve when you are ready to exit the business.

Vetted by industry professionals

Our role is to lead the process and coordinate with our client’s professional advisor team, which includes attorneys, accountants, wealth managers, and other legal and professional roles if needed.

We have earned the trust of top legal, accounting and wealth advisory firms. Many of our clients are referred to us because of that confidence and trust. From evaluation through to completion, Corporate Investment is your trusted partner on all aspects of the transaction, ensuring critical issues are resolved and increasing the likelihood of a successful closing.

On your side of the bargaining table

Our clients are usually busy owner-operators, who do not have the time to have a “second job” of selling their company. We will tailor a package and present your business to the appropriate buyer, to generate more interest and more offers.

Corporate Investment's Austin M&A advisors will guide you through the entire complex M&A timeline

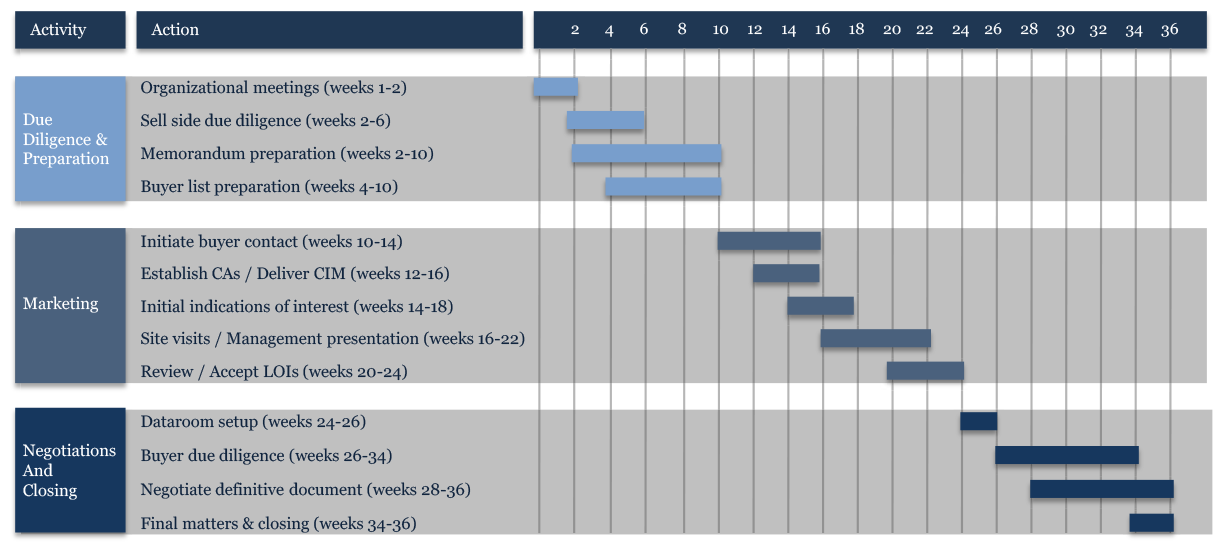

While every transaction is unique, most transactions include similar stages. This chart represents a typical timeline for completion of a business sale. Depending on specific circumstances of the company, its desired objectives and the optimal marketing strategy, this time frame will be shortened or lengthened.

Three types of M&A processes

Broad Auction:

Maximizes the probability of obtaining the highest value by increasing the competitive dynamic in the sellers favor, insures that all likely bidders are contacted, and limits the negotiating leverage of the buyer. The disadvantages are that it’s more difficult to maintain confidentiality, more time consuming, and an unsuccessful outcome can create the impression of an undesirable asset.

Targeted Auction:

Higher likelihood of preserving confidentiality, reduces business disruption, reduces potential of a failed auction by signaling a desire to select a “partner,” while still maintains perception of competitive dynamics, and serves as an adequate “market check.” The disadvantages are that it may miss non-obvious, but credible buyers, there is less competition thereby reducing the seller’s leverage somewhat, and there is potential for the seller to leave money on the table.

Negotiated Sale:

Highest degree of confidentiality, less disruptive than auction, more flexibility with timing, and usually fastest to closing. The disadvantages include limited negotiating leverage for the seller, potential to leave money on the table, may require sharing sensitive data with no assurance of a closing, and provides less market data with which the owner must decide. Still requires management time to satisfy buyer due diligence, and limited ability to keep the buyer moving to closing.

Our M&A advisors work with sellers throughout Texas and the southwest

Corporate Investment is the leading lower middle-market M&A advisory firm with offices in Austin, Texas and San Antonio, TX, serving Texas and the southwest. We have handled hundreds of M&A transactions and routinely handle deals ranging from multimillion dollar privately owned companies to businesses with 50 employees.

Selling a privately owned business is a complicated endeavor, with numerous pitfalls. The Corporate Investment team will guide you through this complex process every step of the way.

Browse our Client Testimonials. Read our Success Stories.

Follow our Blog for tips on selling your business.